Is your family on a tight budget? Are you trying to save money to pay student loans, cover a house mortgage, go on a family vacation or save for retirement?

Whatever your situation, you likely need a budget. If you listen to budget experts, you know you need to create a budget, pay off debt, make wise spending decisions and save for the future, but how do you pay for dental and health insurance, too?

How Does a Budget Work?

- Write down your total income

- List all your expenses

- Subtract those expenses from your income so it equals zero

- Track what you spend throughout the month so you don’t go over what you should spend on each item

It sounds easy, right? Unfortunately, many Americans don’t budget every month, which is part of the problem. Creating a budget is the first step. After that, you’ll have to follow it, which can be challenging.

How to Afford Dental Care on My Budget

Even on a budget, it can be hard to include everything you need, like health and dental insurance. Before you pull your own tooth, learn more about discount dental plans – an affordable dental plan option for you and your family.

A discount dental plan is helpful for individuals and families on a strict budget because membership cost is often less than what you would pay on your own (without your company’s help). You really only pay for the work that you need.

Are Discount Dental Plans Worth It?

Discount dental plans have a low annual fee and there are no caps on how many treatments you can have discounted.

Unless you don’t intend to visit the dentist at all this year, which could accrue higher expenses for dental work later, your money won’t go to waste.

Sallie’s Story

Sallie Didn’t Have Dental Insurance

Sallie lived in Texas and did not have dental insurance. Her employer provided health insurance but not dental insurance.

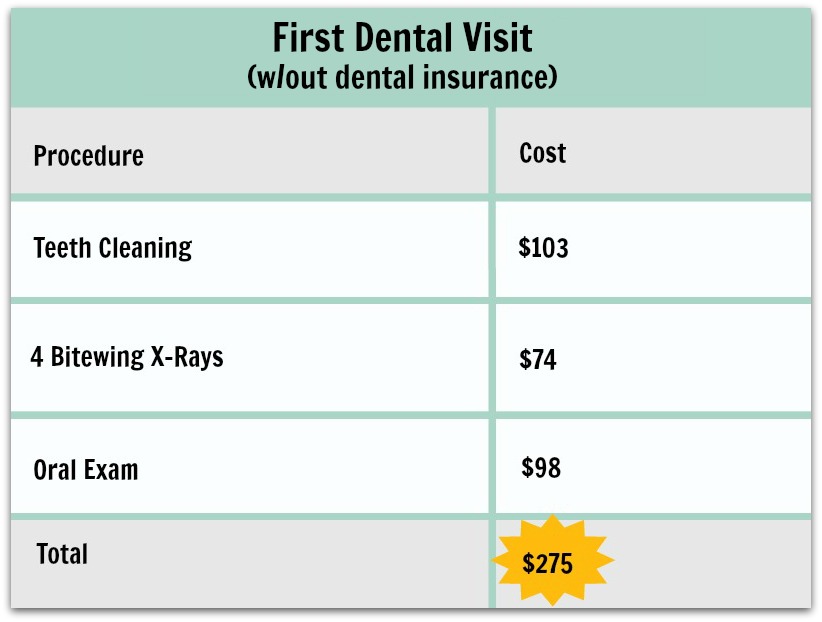

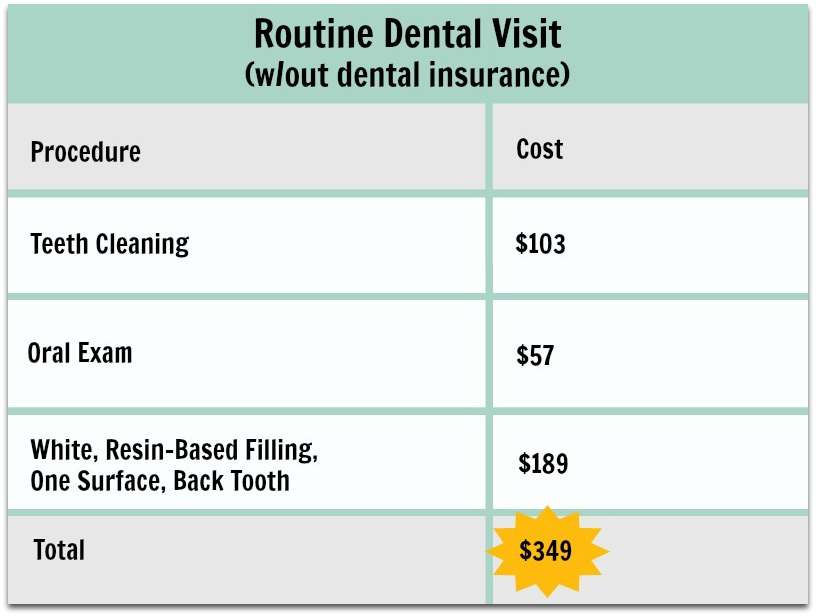

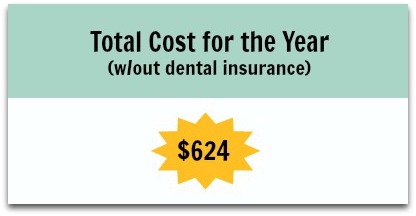

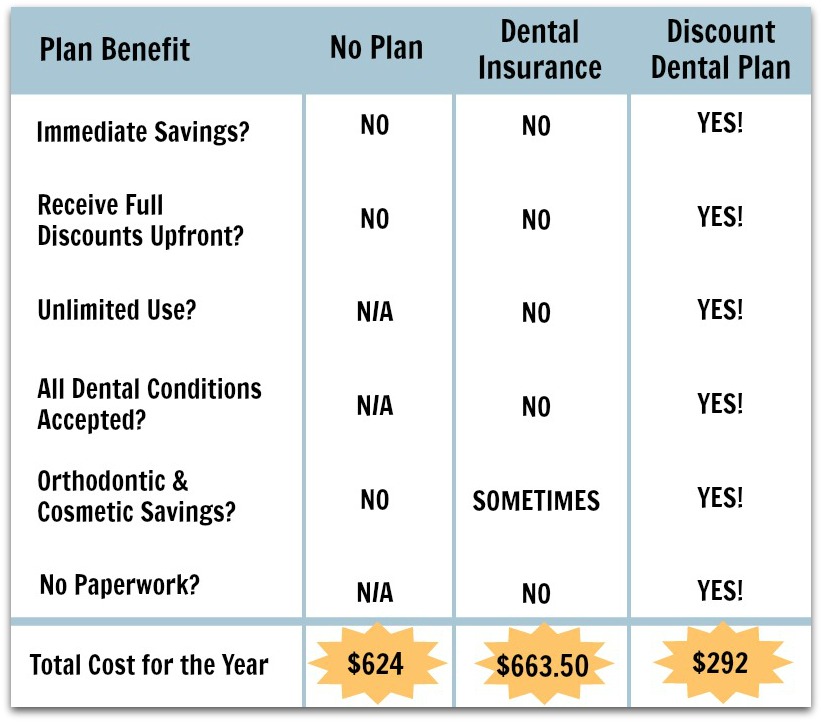

One year, Sallie needed 2 teeth cleanings, dental x-rays, an oral exam and a tooth filling. Sallie paid $624 for the dental work.

The next year, she decided to get dental insurance.

Sallie Purchased Dental Insurance

Sallie purchased dental insurance that was supposed to cover unexpected dental treatments, like tooth fillings or root canals, and include biannual teeth cleanings.

She purchased the insurance plan for $30/month, plus the $35 processing fee. She paid $395 for her dental insurance plan for the year.

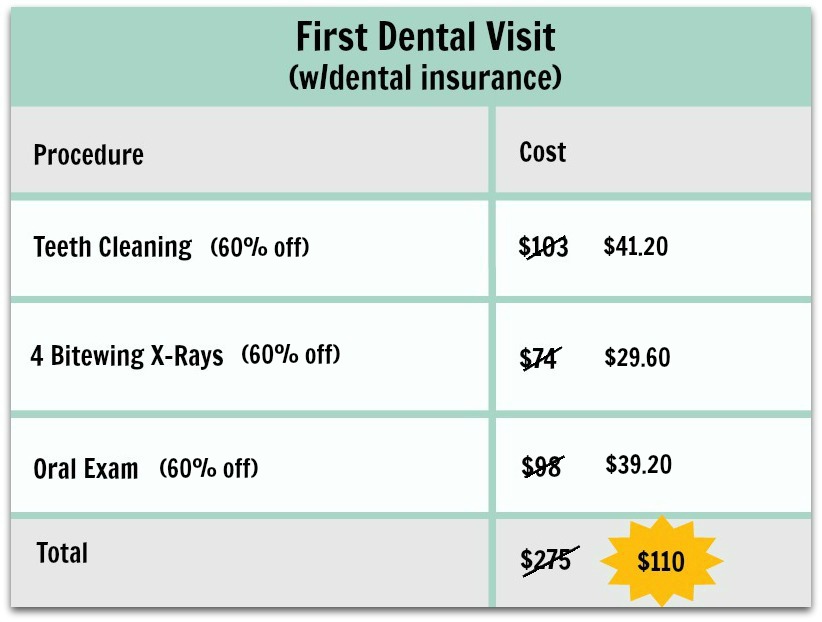

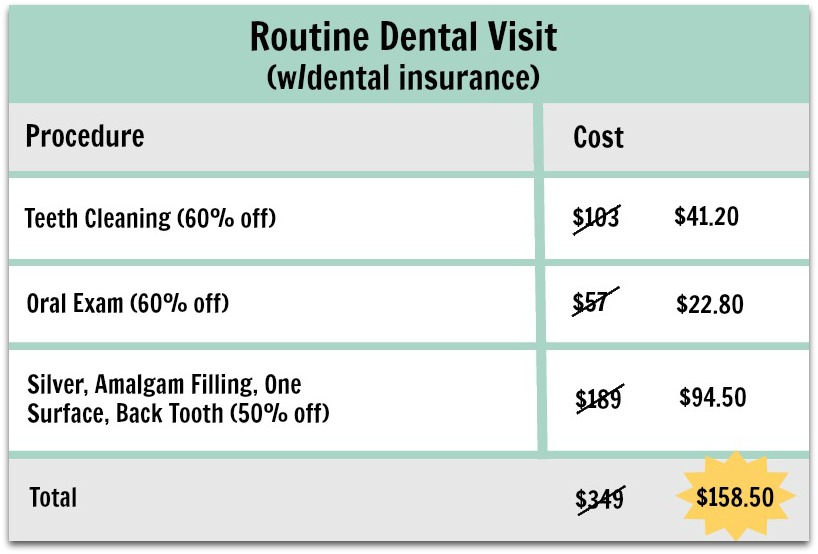

For the first year, her dental insurance offered to pay 60% of her periodic oral exams, teeth cleanings and bite wing dental x-rays and 50% of her amalgam fillings (white, resin-based fillings were not covered by her dental insurance). These percentages kicked in after she paid her $50 deductible for the year.

Sallie had to wait 2 more years before her benefits began, like free dental cleanings and any savings on major procedures.

Combining the cost of her dental insurance plan ($395) and the above dental work cost ($268.50), Sallie paid $663.50 for the year ($40 more than what she paid without dental insurance). If she had really wanted the resin (white) filling, she would have had to pay for it all herself.

Sallie Discovered Discount Dental Plans

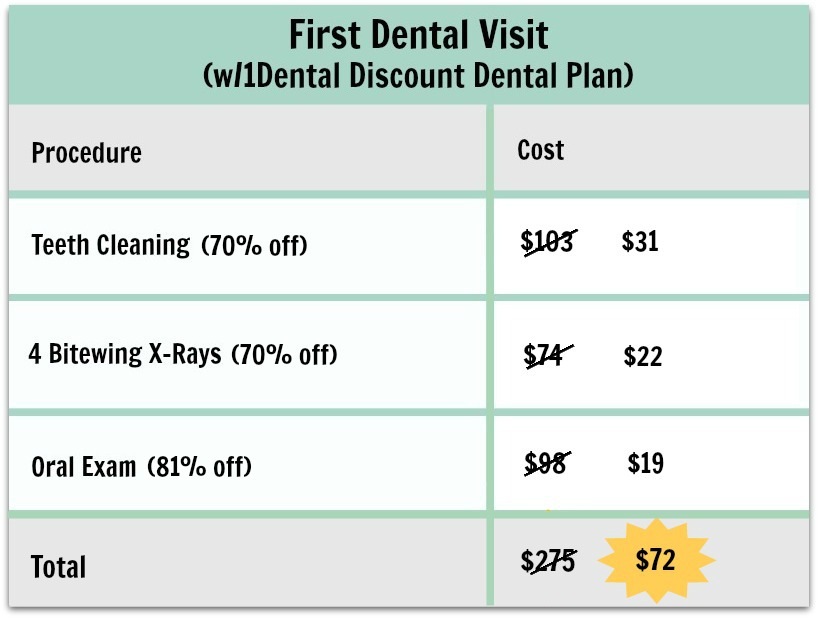

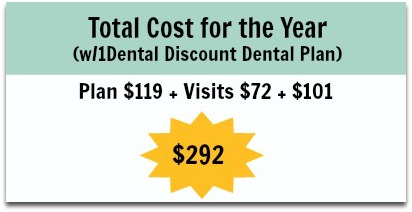

While using her dental insurance plan, Sallie discovered discount dental plans. She decided to try these dental plans instead of dental insurance. She paid $99 for the year (plus a $20 one-time processing fee), which totaled $119 for the first year and would cost $99 each consecutive year.

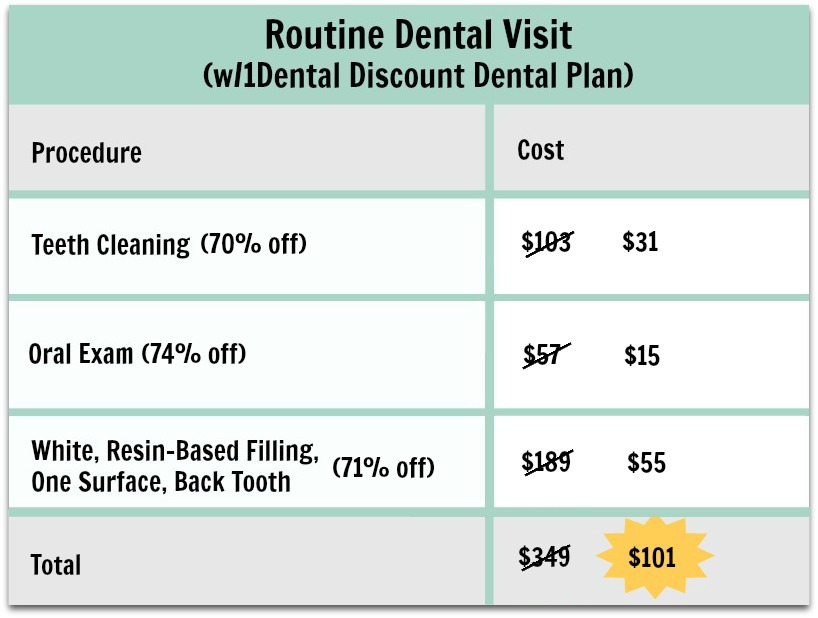

She needed 2 cleanings that year, dental x-rays, an oral exam and one resin-based tooth filling.

She paid $173 for her treatments and $119 for her plan, which brought her total cost for the first year to $292. She saved $451 using a discount dental plan compared to her previous options. She paid only what she needed and none of her money went to waste.

With a discount plan, budget for your annual fee (or multi-year purchase) and set aside money in your account for dental treatments and visits that occur throughout the year. For the most up-to-date treatment prices in your area, please visit the 1Dental fee schedule and enter your zip code.

If you have an HSA or FSA, you can save money in this account and use it to pay for dental expenses (on top of the discounted prices!).

As you build out your budget, consider adding a discount dental plan to the list so you can get the dental care you need while still being able to take that family vacation, pay off your debt, save for retirement and enjoy your life without the stress of outrageous drains on your budget.

Wow, that’s so helpful to see why discount plans help so much. Thanks!

I have been using the Carrington 500 discount at ApenDental in Waterville, Maine and their discounted prices are like double of what you post it to be.

Why such a big difference from what you advertise?

Hi Marcel, thank you for writing to us. It’s possible you may have visited a specialist at their office, which is more expensive. If that is not the case though, please contact our Member Services at (855)772-4512 so they can make sure you weren’t charged incorrectly. They have access to the Quality Assurance department who will be able to enforce the contract if necessary.

Natasha, thanks for the reply.

Their price for a routine cleaning is $143 and I pay $87. Zip 0491

Trust me, I am not complaining, I saved $56.

I am just curious as to the difference.

Does each establishment set their own prices?

Is that good compared to what you quote for Zip Code 76102 where it is $104 and pay $31.

Thanks and I am happy with the savings I get compare to what I would be paying.

I’m glad you were able to still save at the dentist! A couple of things may be happening here, so hopefully this will help clarify the price you’re seeing…

1) When you go in for a routine dental visit, you are charged for the cleaning AND the oral exam (the checkup your dentist does). And if you had any x-rays done, those would have been added to the cost, as well. Were you provided with a detailed receipt for your visit (listing the treatment you received and each treatment’s ADA code)? That could help you compare what you had done with our fee schedule.

We also created this resource this year for our members that I hope you’ll check out! It goes through each visit and shows which types of treatment are most commonly given at each visit with an estimated cost of what that will be (and that specific cost will vary by state): https://www.1dental.com/dental-plan-savings/ We often think (myself included when I first started using the plan) that if I’m just going in for a cleaning, I’ll only be charged for the cleaning, but there is often other things they do at the visit, too, which will add to your bill slightly.

2) You may already be looking at your receipt and seeing that the price of the cleaning they did (just the cleaning) does not match with our fee schedule. The dentists in our network are under contract to charge the rates you see on the fee schedule. If you think you are not being charged correctly, please call Member Services at (855) 772-4512 to go over your bill. They have access to the Quality Assurance team to enforce the contracts with the dentists.

Thanks, the information open my eyes.

Been a fan of Mr Ramsey for years.

Hope this real…..

It’s definitely real! My family alone has saved so much on this plan and I could recount so many stories others have shared with me about how much they’ve saved, too! We had dental insurance before and were discouraged by how much we were paying every month just to have that dental insurance plan AND add to that the amount we still had to pay when we went into the dentist. It was outrageous. The cost of this plan (of which you can pay annually or monthly) plus the awesome discounts you receive at the dental office has been amazing. We don’t feel like we’re wasting money every month paying for a dental insurance plan that isn’t saving us enough at the dentist. We pay an affordable rate for our plan and receive affordable rates at the dentist!

hi ,sir

what is guest post price https://www.1dental.com

waiting your reply

thanks

We don’t pay for or receive payment for guest posts. We decide whether or not to post a guest post based on the topic, quality of content and whether it will be a good fit for our readers. If you have an idea for us of a post you would like to write, you can email us at editor@1dental.com for us to review.